Obtaining a financial license isn’t just permission—it’s a multi-dimensional readiness journey. Setting up a financial institution requires much more than capital and contracts. Regulators like the BRSA, CBRT, CMB, SEDDK, Revenue Administration, and the Risk Center of the Banks Association of Türkiye expect a complete institutional setup—not just “application paperwork.”

That’s where we come in.

Common Problems We Hear

Many new financial institutions underestimate the depth of compliance required before applying for a license. Teams often struggle to implement end-to-end processes that satisfy regulators’ expectations for governance, IT systems, and audit readiness.

| No. | Concern | Solution |

|---|---|---|

| 1 | “We gathered the documents, but our infrastructure failed the audit.” | We offer pre-audit support at the process, system, and documentation levels. |

| 2 | “Legal and tax are sorted—but we don’t know how to manage the IT part.” | We build the IT architecture, infrastructure, processes, and controls for you. |

| 3 | “Which systems should we buy? What should be outsourced?” | We guide you on vendor models and software selection, tailored to your structure. |

| 4 | “Enterprise architecture? Log management? We don’t even know where to start.” | We layer and structure the entire model and deliver it with documentation. |

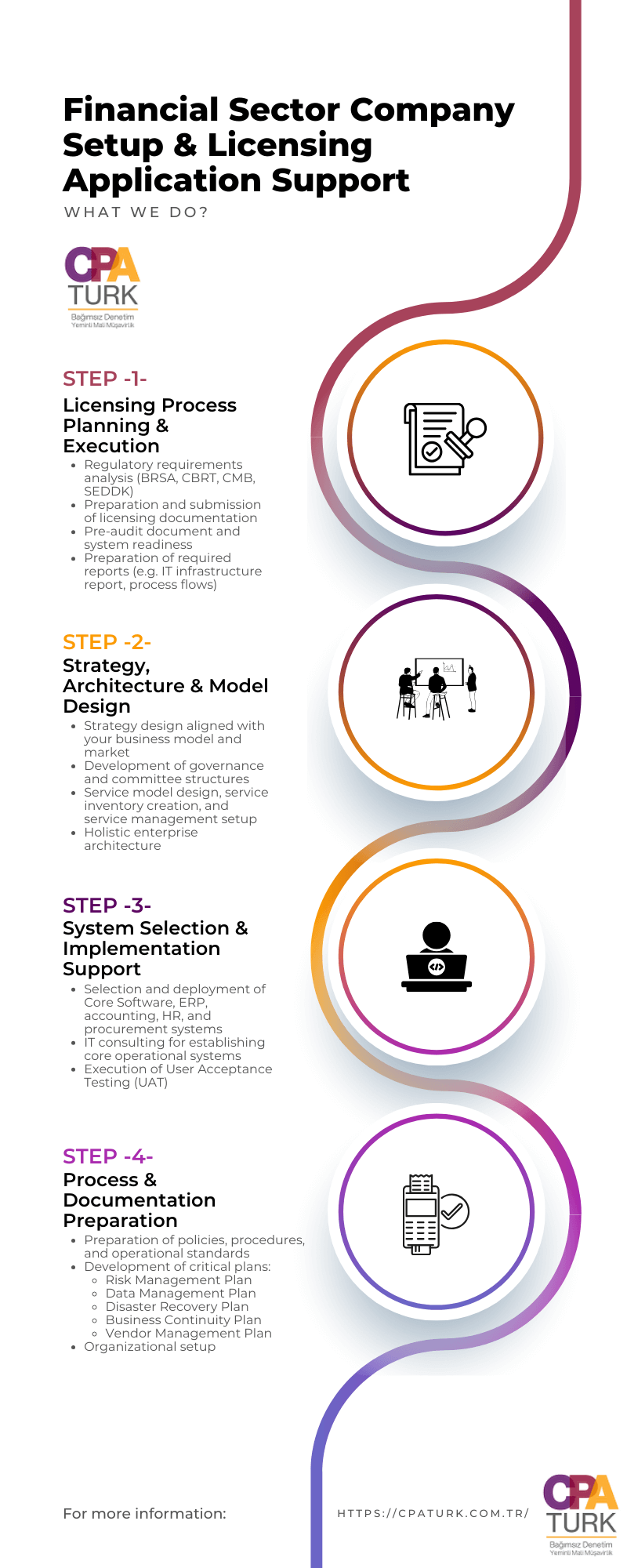

What Do We Do? – Financial Company Formation & Licensing Support

We provide end-to-end support across digital, organizational, and governance areas for newly established financial institutions during company formation and licensing.

1. Licensing Process Planning & Execution

- Regulatory requirements analysis (BRSA, CBRT, CMB, Revenue Admin, SEDDK)

- Integrated project management with legal, tax, compliance, and finance teams

- Preparation and submission of licensing documentation to regulators

- Pre-audit document and system readiness

- Preparation of required reports (e.g. IT infrastructure report, process flows)

2. Strategy, Architecture & Model Design

- Strategy design aligned with your business model and market

- Development of governance and committee structures

- Service model design, service inventory creation, and service management setup

- Definition of sourcing strategies (in-house, outsourced, cloud-based)

- Holistic enterprise architecture (organization, process, technology, control, data)

3. System Selection & Implementation Support

- Selection and deployment of ERP, accounting, HR, and procurement systems

- IT consulting for establishing core operational systems

- Execution of User Acceptance Testing (UAT)

4. Process & Documentation Preparation

- Preparation of policies, procedures, and operational standards

- Development of critical plans: Risk Management Plan, Data Management Plan, Disaster Recovery Plan, Business Continuity Plan, Vendor Management Plan

- Technical documentation: user guides, system manuals, training plans

- Organizational setup: roles & responsibilities, job descriptions, committee principles

- Identification of Key Performance Indicators (KPIs)

What You Get at Project Completion

Key outputs you will receive by the end of the consulting project:

Tech & organizational structures ready for licensing submission

Institution-specific architecture plan, vendor model, and control systems

Regulation-compliant technical & process documentation

Final system inventory—selected & implemented

Pre-audit reports and test scenarios

Transition roadmap toward a sustainable post-license corporate structure

Payment Institution Setup Consulting

Law No. 6493 is not just a framework—it’s a proof of your tech maturity.

If you plan to operate as a Payment Institution or Electronic Money Institution, your business model must fully comply with Law No. 6493, its Regulations, and Communiqués before applying to the CBRT.

A. Application Process Support

- Licensing consulting in line with Law No. 6493

- Preparation of technical and organizational documents for CBRT

- End-to-end, turnkey support for submission

- Creation of committee structures, job descriptions, IT security policies, and process documents

B. Compliance Gap Assessment

- Analysis of your current setup versus regulatory requirements

- Alignment of IT infrastructure, systems, and controls with legislation

- Design of audit-ready processes and systems

C. Post-License Compliance Support

- Ongoing documentation updates and new requirement alignment

- IT consulting for new system needs

- Continuous compliance support aligned with CBRT directives

Regulatory Frameworks in Scope

Below are key regulations and official gazette references that form the foundation of Information Technologies compliance in the financial sector:

| No | Regulator & Regulation | Type | Gazette Date / No | Summary |

|---|---|---|---|---|

| 1 | KVKK – Law on Protection of Personal Data (No. 6698) | Law | April 7, 2016 – 29677 | Personal data handling and security in financial IT systems |

| 2 | BTK – Network & Info Security in Electronic Communications | Regulation | July 13, 2014 – 29059 | Data & network security for bank-fintech partnerships |

| 3 | BRSA – IT Systems & Digital Banking Services | Regulation | March 15, 2020 – 31069 | IT governance, cloud, outsourcing, cybersecurity, data governance |

| 4 | BRSA – Independent Audit Report Format for IT in Banks | Communiqué | Dec 5, 2006 – 26367 | Mandatory IT audit every 3 years for banks |

| 5 | BRSA – IT Management & Audit for Leasing, Factoring & Finance Firms | Communiqué | April 6, 2019 – 30737 | Mandatory IT governance and audit (every 3 years) |

| 6 | CBRT – IT & Data Sharing for Payment & E-Money Institutions | Communiqué | Dec 1, 2021 – 31676 | API sharing, IT governance, mandatory audits for Law No. 6493 |

| 7 | CMB – Independent IT Audit Communiqué (III-62.2) | Communiqué | Jan 5, 2018 – 30292 | IT audits for brokerages, portfolio firms, exchanges |

| 8 | CMB – IT Governance Principles (VII-128.10) | Communiqué | March 13, 2025 – 32840 | Strategy, risk, continuity, data & third-party governance in capital markets |

| 9 | Revenue Administration – General Communiqué on Tax Procedure Law (No. 509) | Communiqué | Oct 19, 2019 – 30923 | e-Invoice, e-Archive, and e-Document integration in financial institutions |

Note: Regulation numbers and dates are cited based on Official Gazette references. Projects always reflect the most updated versions available at the time of execution.