It’s not enough for everything to seem right. You need to prove it. In today’s financial sector, success is not judged solely by outcomes—but also by process, traceability, and evidence.

Auditability of digital operations, regulatory compliance, and assurance reporting are no longer “nice-to-have”—they’re the new baseline. Moreover, compliance obligations apply not only to your organization but also to affiliates, external service providers, FinTech partners, and vendors.

We Often Hear:

-

“Our IS function works fine—but we have no system to prove it to the regulator.”

→ We develop audit trails, assurance reports, and supporting documentation sets. -

“Every audit season is a stress storm—everything is manual.”

→ We design systematic controls to make audits repeatable and less painful. -

“We started working with a new partner—but we don’t know which regulations apply.”

→ A compliance map is developed, with clear roles and regulatory scope. -

“International investors requested a SOX-aligned audit—we’ve never done that before.”

→ We carry out assurance audits tailored to SOX, Euro-SOX, J-SOX, and other standards.

What is IT Compliance Consulting?

IT compliance consulting is the process of aligning a company’s digital operations with legal regulations, security standards, and corporate policies.

What We Do

With our Information Systems Compliance & Audit Services, we help you implement auditable, regulation-aligned, and evidence-based IS systems.

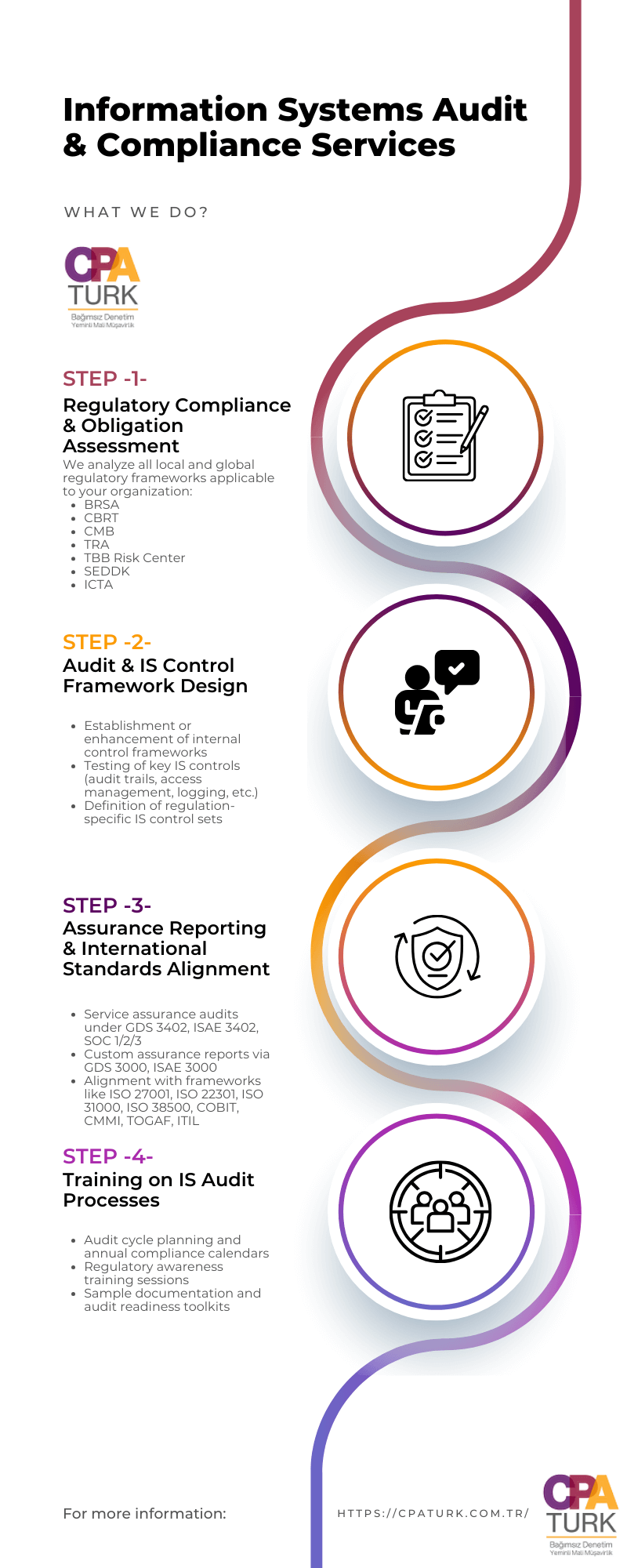

1. Regulatory Compliance & Obligation Assessment

We analyze all local and global regulatory frameworks applicable to your organization:

- BRSA (Banking Regulation and Supervision Agency): IS & Internal Systems regulations — For banks, affiliates, outsourcing providers, factoring, leasing, financing, and asset management firms

- CBRT (Central Bank of the Republic of Türkiye): IS regulations — For payment services, securities settlement, and e-money institutions

- CMB (Capital Markets Board): IS regulations — For brokerage houses, portfolio managers, and capital market institutions

- TRA (Revenue Administration): IS regulations & Secure Service Providers — e-Invoice, e-Dispatch, e-Archive, special integrators, fiscal devices (YNÖKC), TSM

- TBB Risk Center: IS requirements for data submission and risk reporting

- SEDDK (Insurance & Private Pensions Regulatory Authority): IS regulations for insurance and pension sectors

- ICTA (Information and Communication Technologies Authority): Telecommunications IS & compliance with Personal Data Protection Law

- Other digital ecosystems: e-General Assembly, e-Signature, e-Notification, KEP, and e-Commerce systems

- Special frameworks: KGK (Public Oversight Authority) and other regulators

2. Audit & Control Framework Design for IS

Systems are only as strong as their auditability:

- Establishment or enhancement of internal control frameworks

- Testing of key IS controls (audit trails, access management, logging, etc.)

- Definition of regulation-specific IS control sets

- Test scenario design in coordination with audit functions

- Setup of automation, monitoring, and reporting tools

3. Assurance Reporting & International Standards Alignment

Compliance is not enough—you need to demonstrate it:

- Service assurance audits under GDS 3402, ISAE 3402, SOC 1/2/3

- Custom assurance reports via GDS 3000, ISAE 3000

- Alignment with frameworks like ISO 27001, ISO 22301, ISO 31000, ISO 38500, COBIT, CMMI, TOGAF, ITIL

- Analysis of IS requirements under SOX, Euro-SOX, J-SOX

- Impact assessments for DORA, DSA, DMA (EU regulations)

- Compliance considerations for IFRS 9, 15, 17, and Basel/Solvency frameworks

4. Operational Management of Audit Processes & Training

Compliance is not only system-driven—it’s people-powered:

- Audit cycle planning and annual compliance calendars

- Regulatory awareness training sessions

- Coordination between IS teams and internal auditors

- Sample documentation and audit readiness toolkits

What You’ll Walk Away With:

Comprehensive regulatory compliance deliverables tailored for your institution:

Custom Regulatory Compliance Map tailored to your institution

Audit-ready IS Control Set and identified control gaps

Complete documentation packages (evidence logs, policy records, compliance documents)

Prepared templates for GDS / ISAE / SOC / SOX assurance reporting

Compliance calendar, testing schedules, and sustainability roadmap

Comprehensive compliance coverage for Türkiye-specific regulations (BRSA, CBRT, CMB, TRA, ICTA, etc.)