The guarantee of uninterrupted service, security, and reputation: being prepared. The financial system never sleeps. A one-second interruption doesn’t just mean halted transactions—it means lost customers, regulatory violations, and reputational damage.

Cyberattacks, system failures, human errors, natural disasters… Institutions that are unprepared risk losing more than systems—they risk their brand.

Common Concerns We Hear:

-

“If a disruption happens, no one knows who does what.”

→ Emergency roles and workflows are clarified and reinforced through simulations. -

“We have a business continuity plan, but it hasn’t been updated in years.”

→ Existing plans are assessed and updated to meet today’s needs. -

“We have backups, but we don’t know if they’ll work in a disaster.”

→ Backup and recovery processes are tested, and gaps are identified. -

“We rely on vendors, but we don’t know if they have continuity plans.”

→ Third-party service providers’ continuity maturity is evaluated. -

“There are process-based risks, but we’ve never measured their impact.”

→ Business Impact Analysis (BIA) is conducted based on service disruptions.

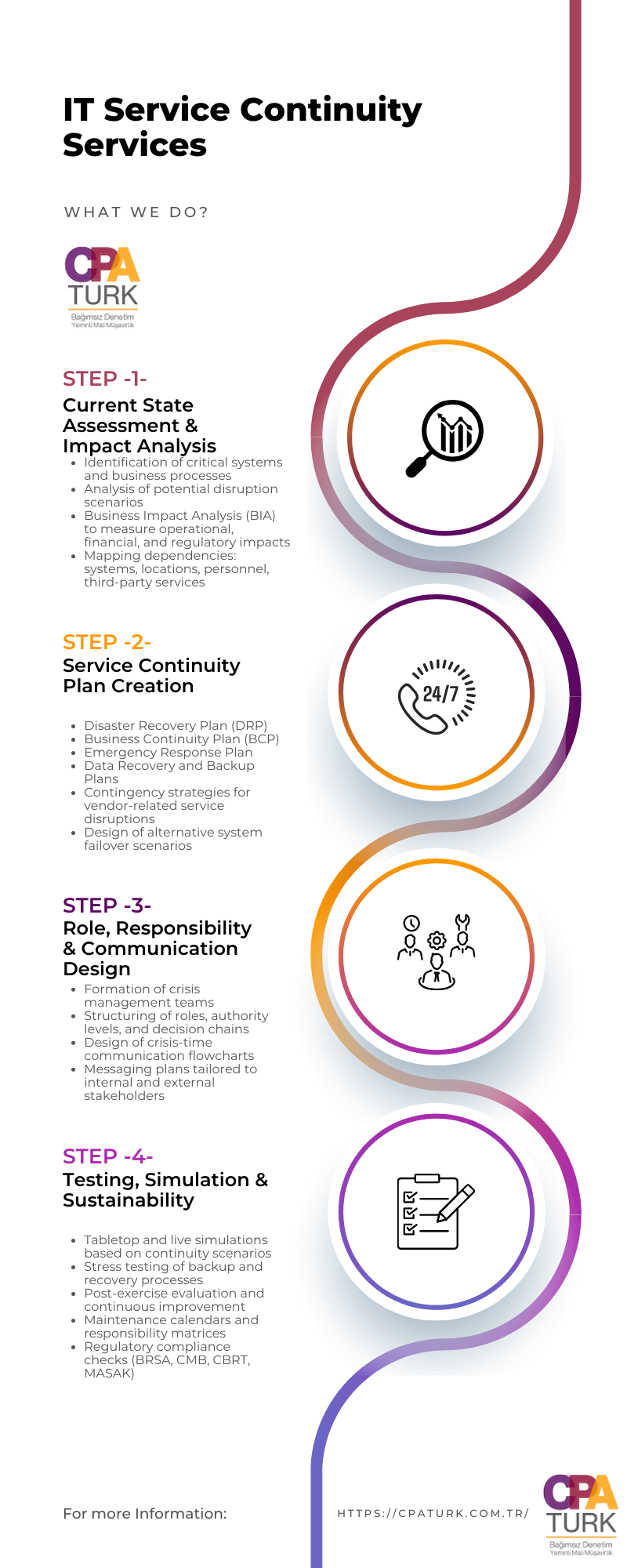

What We Do: Scope of our IT Service Continuity Consulting

Through our IT Service Continuity Consulting for the financial sector, we build an end-to-end infrastructure that enables uninterrupted digital operations.

1. Current State Assessment & Impact Analysis

The first step is understanding the risks and dependencies:

- Identification of critical systems and business processes

- Review of current continuity, disaster recovery, data management, and backup plans

- Analysis of potential disruption scenarios

- Business Impact Analysis (BIA) to measure operational, financial, and regulatory impacts

- Mapping dependencies: systems, locations, personnel, third-party services

2. Plan Creation and Updating

A plan that isn’t tested and updated is not a real plan.

- Disaster Recovery Plan (DRP)

- Business Continuity Plan (BCP)

- Emergency Response Plan

- Data Recovery and Backup Plans

- Contingency strategies for vendor-related service disruptions

- Design of alternative system failover scenarios

3. Role, Responsibility & Communication Design

Who leads the crisis, when, and how?

- Formation of crisis management teams

- Structuring of roles, authority levels, and decision chains

- Design of crisis-time communication flowcharts

- Messaging plans tailored to internal and external stakeholders

4. Testing, Simulation & Sustainability

A plan is only valuable if it works when needed.

- Tabletop and live simulations based on continuity scenarios

- Stress testing of backup and recovery processes

- Post-exercise evaluation and continuous improvement

- Maintenance calendars and responsibility matrices

- Regulatory compliance checks (BRSA, CMB, CBRT, MASAK)

What You’ll Have at Project Completion:

Comprehensive business continuity and disaster recovery deliverables:

Business Impact Analysis (BIA) & Critical Process Mapping

Up-to-date and actionable Business Continuity Plan (BCP)

Comprehensive Disaster Recovery Plan (DRP)

Validated backup and data recovery scenarios

Simulation Plans & Testing Reports

Crisis Communication & Response Framework

Alternative action plans for third-party risks